🏆 Process vs Outcome, focus & principles for success

Issue 11

Dear friend,

I hope you’ve had a great week. Here’s your weekly roundup of investment principles & interesting links…

Process vs Outcome

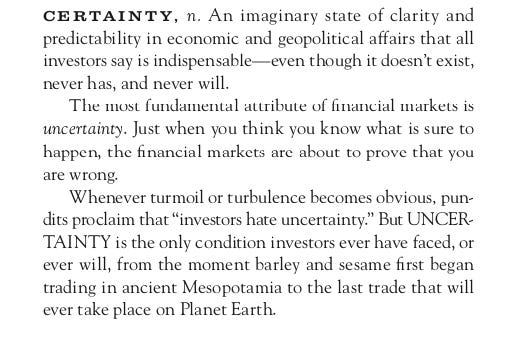

Last week we looked at how uncertainty about the future is the normal investing condition.

Yesterday I saw the following definition of certainty, from Jason Zweig’s ‘The Devil's Financial Dictionary’:

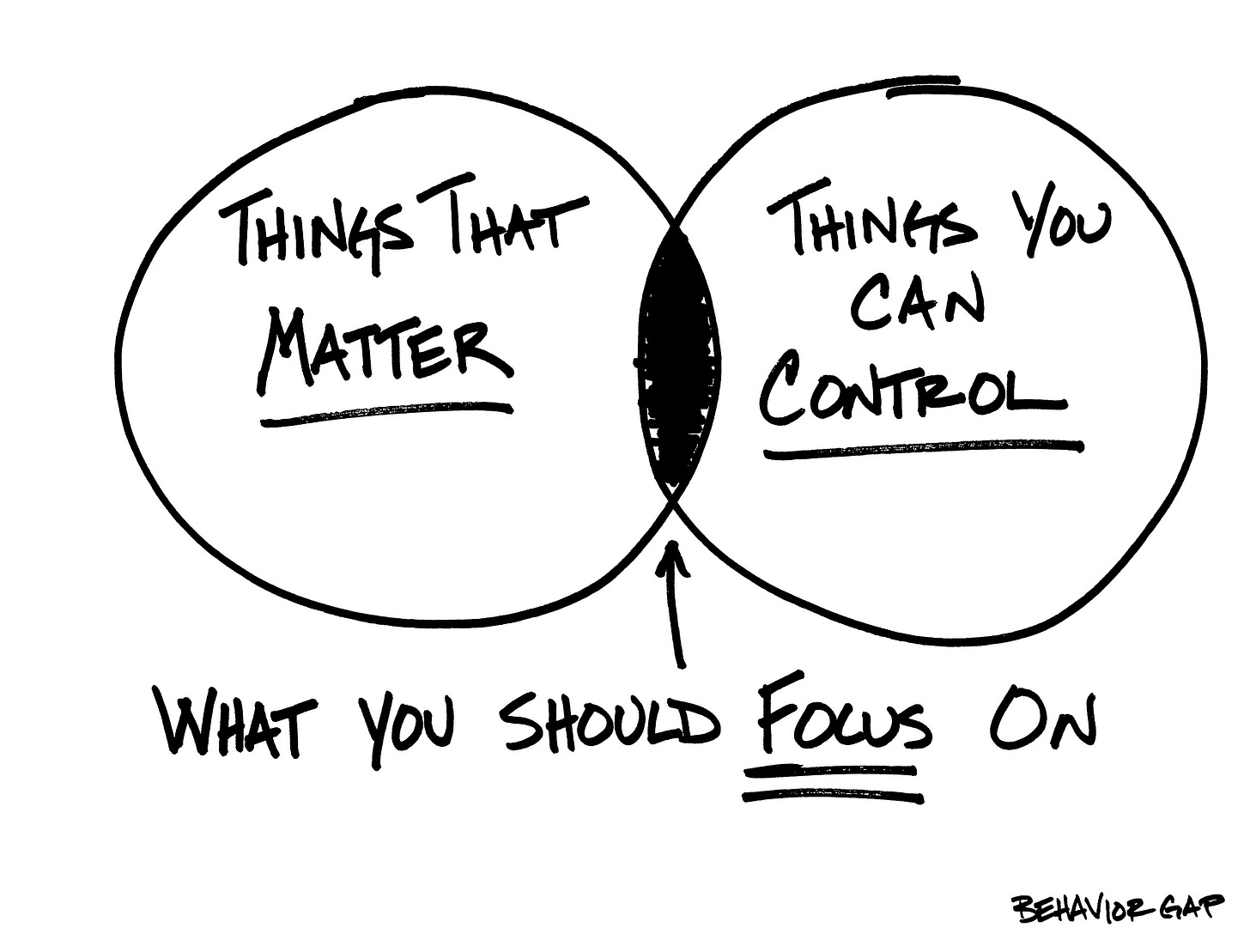

I mentioned that a sensible take-away from this reality is to focus on the things you can control. Another way of framing this is to focus on the process, not the outcome.

Nick Maggiulli explored this concept in an article last year:

"There is nothing you or I can do to effect future equity returns. You cannot control that outcome. You cannot control being at the right place at the right time (for the most part).

But, you can control your process. You can control who you pick as your financial advisor, your savings rate, the fees you pay, and so much more.

In fact, when it comes to almost every decision you make in life, you should completely ignore the outcomes as long as your process is logical and evidence-based.

This idea comes from Annie Duke‘s book Thinking in Bets where she discusses how most people retroactively judge a decision-making process based on the outcome of the decision. This is why Annie recommends excluding any talk of outcomes when analyzing decision quality, especially when you have incomplete information.

For example, you wouldn’t think that someone who drove home drunk and survived had a good decision-making process. Why? You have information that suggests otherwise.

However, when someone gets rich by day trading you aren’t as sure as to whether this was good decision-making or good luck. You have less information, so you are more prone to judge the decision based on the outcome.

As I have discussed before, focus on your efforts, not your results. It’s the only thing you can control."

These ideas aren’t novel. As the Stoic philosopher and one-time slave Epictetus wrote more than 1,900 years ago:

“The chief task in life is simply this: to identify and separate matters so that I can say clearly to myself which are externals not under my control, and which have to do with the choices I actually control. Where then do I look for good and evil? Not to uncontrollable externals, but within myself to the choices that are my own . . .”

“Some things are up to us and some are not up to us.” If you embrace the idea of controlling only the things you can control, he wrote, then you must “try not to be carried away by appearance, since if you once gain time and delay you will control yourself more easily.”

Are you focusing on the right things?

Reader’s Digest

🥅 The power of focus: Why you should tackle one goal at a time [7 minutes]

“One of the teaching skills that is developed in good coaches is the concept of “one fault, one correction”. The idea is to take the most important correction needed and just focus on that one thing. Attack it from different angles if needed, but be tenacious on correcting the biggest fault only. Once that has been achieved, the Coach and Athlete can move on to the next biggest fault, then the next and so on, in a never-ending journey toward excellence.”

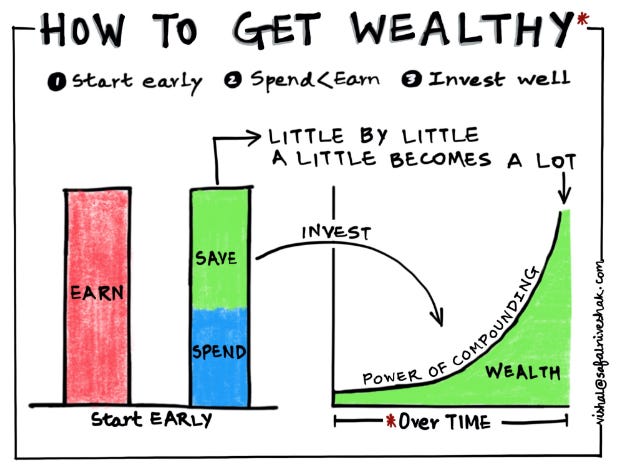

🧢 Six effective financial habits to adopt [4 minutes]

“Spending within your means and saving to build financial security for when you can no longer work are the foundations for high financial wellbeing. But money issues can be abstract, complex and emotionally challenging to navigate, due to our primeval hard wiring that makes us favour immediate pleasure over deferred gratification. So if your earning, spending, saving and investing habits need improving and updating, here are some ideas that might help.”

🍀 How "Resulting" Impacts Your Personal Finances [3 minutes]

“All around us people confuse the results of a decision to be completely linked to the decision making process that went in. This is the concept of "resulting", or drawing a conclusion on the soundness of a decision based on the outcome, rather than whether there was a sound decision making process that gave you the best chance of a favorable outcome.”

💸 Where I Have Found the Most (and Least) Value Spending Money [4 minutes]

“In the world of investing, everything we invest our cash in is expected to produce a monetary return. But in the world of life, the best investments often produce benefits that are impossible to quantify. So I will focus my list on some unconventional things that have produced the most happiness for me and my family, even if they made little sense from a monetary perspective.”

🤷♂️ The Five Sources of Uncertainty [12 minutes]

“You should respond differently to different sources of uncertainty. For instance, responding to a lack of information is different from dealing with information you can’t interpret. This is easy to say, but usually difficult to do: often, we attempt to resolve the latter scenario with a search for more information — perhaps to avoid admitting to ourselves that we can’t interpret what we have at hand.”

Podcast

🎧 Behavior Gap Podcast - What's Money For Anyway? [6 minutes]

Video

Ray Dalio’s popular book “Principles” has been distilled into a 30 minute ultra mini series that focuses on the life principles that have helped him the most.

Social

Infographic

Personal

Until next week,

Pierre

p.s. If you’d like to chat, let’s find a time.

If you enjoyed this newsletter, please share it with a friend. You can forward the email or encourage them to sign up here.