Hello!

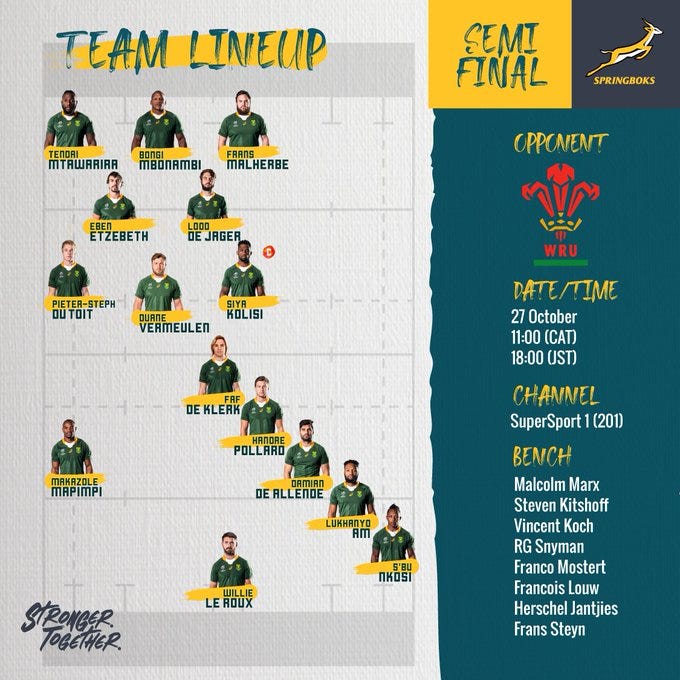

We have two games to play at the World Cup, and hopefully we won’t be playing next Friday.

I’m predicting a SA vs NZ final…

Reader’s Digest

Deferred gratification is hard but not impossible to learn [3 minutes]

A dissenting view about the instant gratification, you-can-have-it-all-right-now economy has been memorably expressed by Charlie Munger, the business partner of legendary investor Warren Buffett and a man known for turning conventional wisdom on its head. “Waiting helps you as an investor and a lot of people just can’t stand to wait,” Munger once said. “If you didn’t get the deferred-gratification gene, you’ve got to work very hard to overcome that.”

The ability to forgo today’s desires for the prospect of longer-term fulfilment is one of the most elemental requirements for success as an investor. Buffeted by media noise and the lure of short-term returns, we have to be able to resist the temptation to tinker.

What Investor Biases Are Extraverts Most Prone To? [5 minutes]

Loss aversion is widespread among investors and is probably the most common bias of all. Investors will often sit with losing investments for long periods of time to avoid taking losses and moving on. Beware that this is one of the worst strategies because holding losing investments for too long can be harmful to your investment health.

Interest in investing biases exploded after the financial crisis showed investing has as much do with behavior as it does spreadsheets. But not all biases are bad, and we can become side-tracked obsessing over mental errors like psychologists were 30 years ago. Some biases – intuitions that aren’t backed up with facts – can be lifesavers. You won’t find these biases in a textbook. I made them up. But that’s the point – we’re not discussing them enough, and underappreciating how helpful they can be.

Eliud Kipchoge & The Power of Great Planning [3 minutes]

You can only meet your personalised future financial goals if you put in place an actionable tailored financial plan. A financial training schedule so to speak, using proven strategies most others overlook. Specifically knowing what you want to achieve and implementing the right savings or withdrawal rates, simultaneously considering behaviour, risk management, asset allocation, tax management, costs and charges.

Podcast

🎙️ We don’t just feel emotions. We make them. [63 minutes]

The easiest way to access the podcasts I share is to subscribe to the Simple Wealth Newsletter Curated Podcast Playlist in your podcast app of choice. Copy the link below and paste it into your podcast player to subscribe to my playlist.

https://www.listennotes.com/listen/simple-wealth-newsletter-curated-podcast-o2D_073OiBn/rss/

What I’m Reading

Small Giants: Companies That Choose to Be Great Instead of Big

![Small Giants: Companies That Choose to Be Great Instead of Big, 10th-Anniversary Edition by [Burlingham, Bo] Small Giants: Companies That Choose to Be Great Instead of Big, 10th-Anniversary Edition by [Burlingham, Bo]](https://substackcdn.com/image/fetch/$s_!SHdc!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2F9b5b5856-8bf3-4ac4-a008-5e6daa6a513f_326x500.jpeg)

Infographic

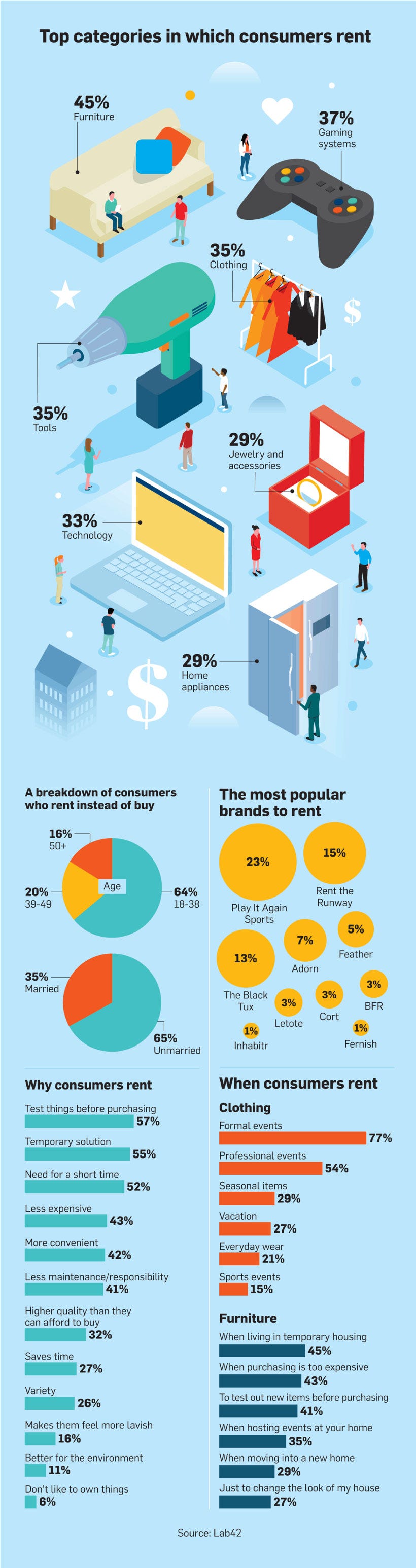

Generation Rent: How Millennials are Fueling the Rental Economy

Social

Until next week,

Pierre

If you enjoyed this newsletter, please share it with a friend. You can forward this email or encourage them to sign up here. If you’d like to chat, let’s find a time.